Check out Trustworthy Manufacturers of High Quality Soft Toys

6.24.2024, 5:30:16 PM

6.24.2024, 5:30:16 PM

390

390

6.24.2024, 5:30:16 PM

6.24.2024, 5:30:16 PM

390

390

If you are struggling to find reliable soft toy factories, then your search ends here, for we have selected over 150 reliable and trustworthy certified suppliers of soft toys. Those manufacturers have long experiences in creating soft toys and maintain good cooperation with global famous brands.

Selected Soft Toy Factories

Dongguan Yuan Kang Plush Toy Co., Ltd

Main Buyers: Mead Johnson, Walmart, Coca-Cola, McDonald's, and Kraft.

Factory Certificates: IETP, ISO, FCCA, FAMA, SCAN.

Featured Products

Qingdao Future Toys Co., Ltd

Main Buyers: Walmart, Target, Walgreens, Carrefour, Costco, Miniso

Factory Certificates: ISO 9001, FCCA, SQP, WCA, GRS

Featured Products

Yangzhou An'best Toys Co., Ltd

Main Buyers: Disney, Universal Studios, Walmart, Target, Costco, McDonald's, Nestle

Factory Certificates: ICTI, BSCI, SEDEX

Featured Products

Dongguan Hugkis Cultural Industrial Co. Ltd.

Main Buyers: Disney, McDonald's, Warner

Factory certificates: FAMA, GSV, IETP

Featured Products

Dongguan Joy Sum Toys Manufacturing Co. Ltd

Main Buyers: Coca-Cola, Walmart, Disney, McDonald's

Factory Certificates: ICTI, ISO, GSV

Featured Products

2024 China Toy Expo (CTE), a must-visit yearly trade show, is Asia’s largest toy fair featuring 2,500+ exhibitors, 500,000+ products, and 5,000+ brands.

And Win Three-night Accommodation

Contact Us

Mr. Sam Jia

Sam_jia@tjpa-china.org

Follow Us:

Precise Insights into Parenting Anxiety! These 4 Toy Categories Become New Favorites Among Gen Z Parents

As consumer demands evolve and parenting concepts iterate, toy products continue to innovate. In 2025, the infant toy market welcomes a new wave of innovation, spanning sensory training to social enlightenment, and role-playing to cognitive development. Global toy brands are competing for user mindshare through differentiated designs. This article analyzes 15 new infant toys recommended by ToyInsider across four core categories, offering fresh perspectives for product R&D.

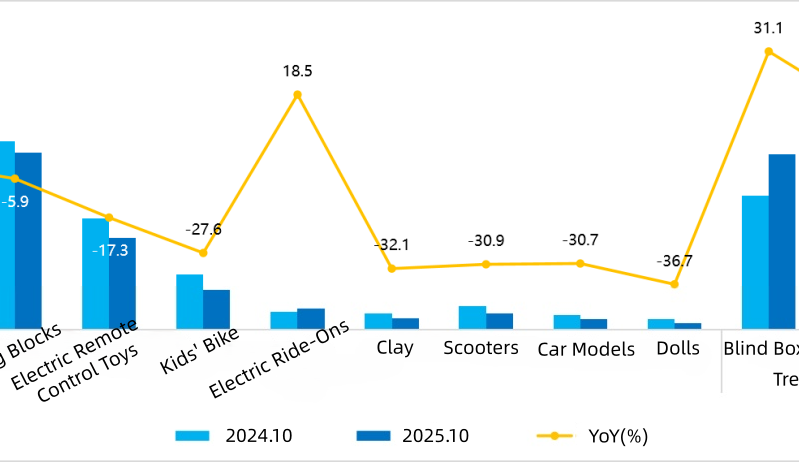

China Market Insight: Toys & Baby Products Accelerate in October as Tmall Promotion Drives Strong Demand

Shanghai, China — The China Toy & Juvenile Products Association (CTJPA) today released its latest analysis of Tmall’s October sales data, revealing significant momentum in China’s toy, trendy toy, and baby product categories. Benefiting from the pre-sales and first wave of the “Double 11” shopping festival, October has become a key indicator of consumer sentiment and product acceptance in the Chinese market.

How to Properly Unlock Emotional Value? Four Emerging Trends Revealed by 16 Best-Selling International MESH Toys

In recent years, the mental health challenges faced by children and adolescents have become increasingly prominent, drawing widespread societal attention. In response, the toy industry has swiftly recognized this trend and is accelerating its transformation from traditional "entertainment tools" to becoming "emotional companions" for children. Among these innovations, MESH toys have garnered significant attention and are rapidly emerging.

Connect with World Class Plush Toy Manufacturers at China Toy Expo 2025!

China's plush and soft toy suppliers are no longer just manufacturers — they are design-driven, trend-savvy, and globally competitive partners with robust international supply chain capabilities. These companies combine creative design, efficient production, and proven export experience to meet the fast-evolving demands of global markets.